Stuff Worth Knowing for the Week of August 7, 2023

Nvidia and AMD pivot hard into AI, Apple buys up 3nm chips, and ESPN gets into sports betting.

Stuff Worth Knowing for the Week of August 7, 2023

Welcome back to Stuff Worth Knowing! Each week, I'll round up news related to tech, video games, film, television, anime, and more.

Nvidia and AMD Pivot To AI Over High-End Gaming

There’s gold in them thar hills! Even if the hills themselves are digital, the gold itself is still real. That’s the key to a recent pivot in the tech industry, especially when it comes to graphics card manufacturers.

For years, Nvidia Corporation and Advanced Micro Devices, Inc. (AMD) have been dueling for control of graphics processing units (GPUs) in desktops, laptops, and gaming devices. Every few years, one or the other would land on a particularly strong chipset or software feature that would power them to the top of the heap. Outside of that, both have also offered products for enterprise, data centers, and high-end entertainment.

Recently, there’s been a shift in both companies, led primarily by Nvidia. While other companies like OpenAI, Alphabet, or Anthropic want to create impressive large language models and other generative AI projects, Nvidia and AMD want to power those services. This week offered two stories highlighting that shift, one concrete and another mere rumor at the moment.

Let’s start off with the rumor. Over on X/Twitter, rumormonger Kepler said that AMD’s upcoming RDNA 4 line-up of products would not compete on the high-end. This information was backed up by Moore’s Law Is Dead, who stated that AMD was having issues with the upcoming product, choosing instead to focus on nailing the next high-end lineup and catching up to Nvidia’s AI product.

The second story was over at Barron’s, which reports that Nvidia’s top-of-the-line H100 GPUs are entirely sold out, until 2024 at the least. Folks like former Meta consultant John Carmack noticed that the prices of H100s were four times above market value in April, and the situation hasn’t gotten better.

That’s a problem for existing companies and start-ups trying to build their AI platforms, as Nvidia not only offers the best hardware currently, it also has its best-in-class CUDA development platform. Many developers are used to working with CUDA, meaning competitors like AMD and Alphabet have to catch up in terms of mindshare and expertise.

Money On My Deep Mind

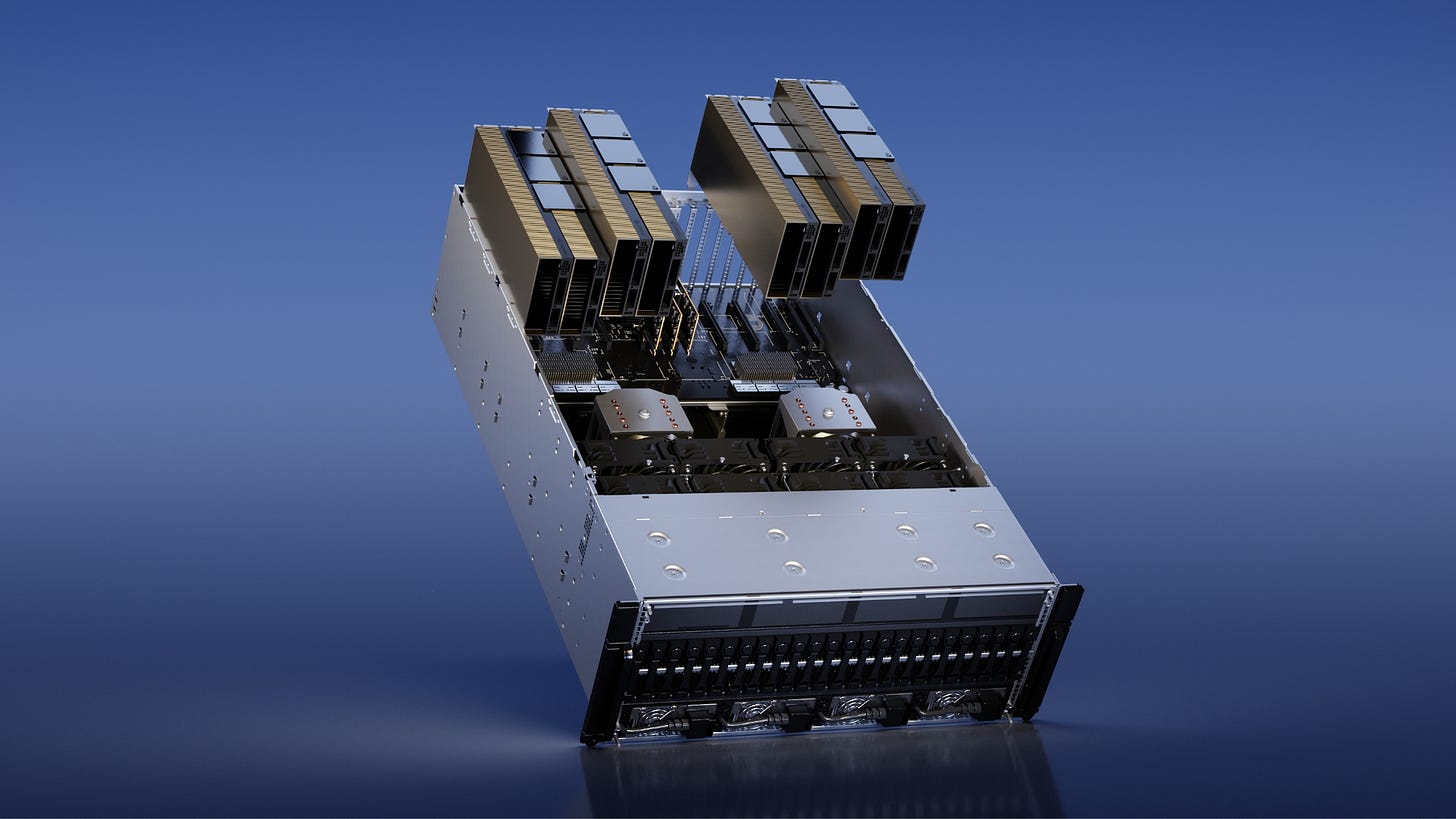

Both companies have their minds on the AI gold rush. For Nvidia, the results are already clear. Its stock price is up 180% this year so far, with the company valued at over $1 trillion. For the first quarter for fiscal year 2024, its data center division—which includes its AI products—reached $4.28 billion in revenue, up 14% year-over-year. In contrast, the gaming division was down 38% to 2.24 billion. Nvidia is also already preparing for its next AI product: the GH200.

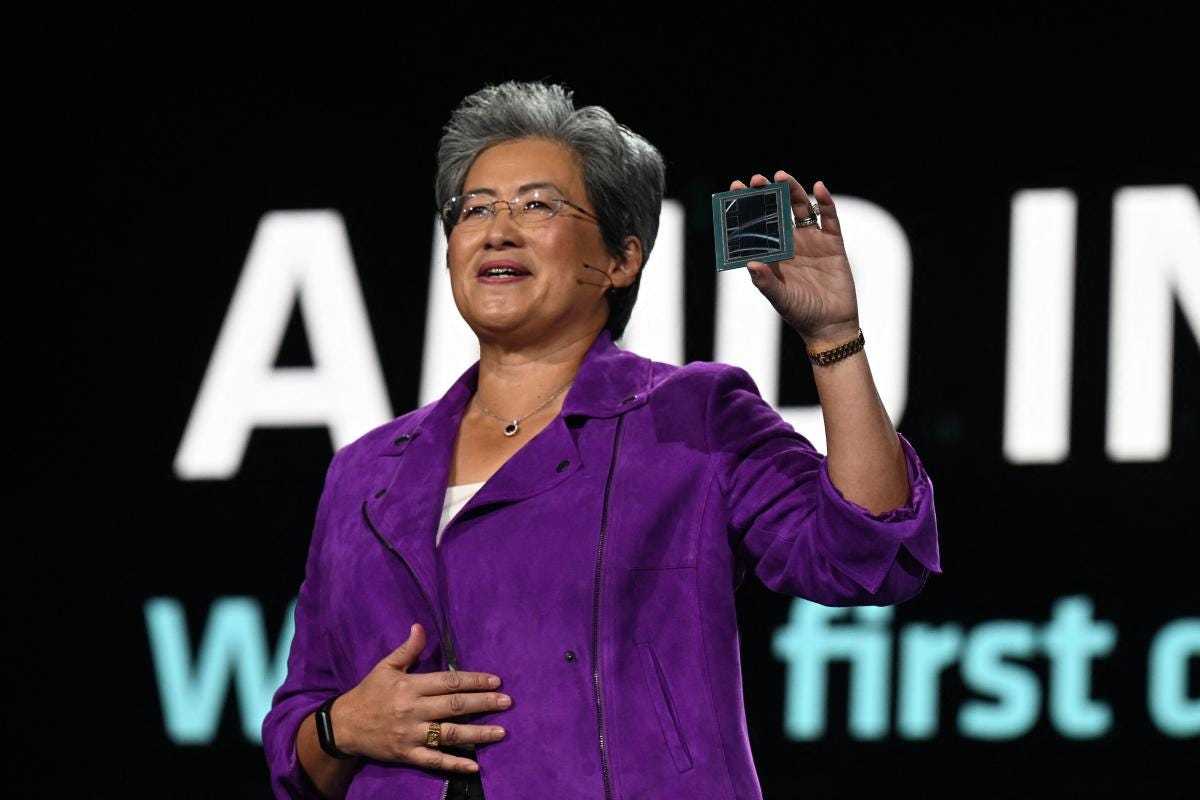

AMD is busy trying to come up from behind, with the June announcement of its MI300X GPU built specifically for AI. “We think about the data center AI accelerator [market] growing from something like $30 billion this year, at over 50% compound annual growth rate, to over $150 billion in 2027,” AMD CEO Lisa Su said at the time, according to CNBC. Unfortunately for AMD, Nvidia has around an 80% market share in AI. The bright side: with the H100 out-of-stock, AMD has space to sell the MI300X (and smaller MI300A) as an alternative when it releases later this year.

The focus is clear even in both companies’ branding efforts. Look up Nvidia and AMD on Google search right now and you’ll see “NVIDIA: World Leader in Artificial Intelligence Computing” and “AMD | together we advance_AI” in their main site descriptions. While it might be a bubble, the money being spent on AI in the short-term is very, very real. Both want to be the vendor of choice for all of these new startups that’ll burn out in the next few years.

Will The Bubble Pop?

Of course, going all-in on AI is smart now, but will that demand hold up long-term? It’s hard to tell. As I’ve noted before, the services being offered as “AI” now are something a few companies have been doing for years at this point. OpenAI just gave it a new face and branding focus.

“If you look at the recent earnings transcripts from S&P 500 companies, the mentions of AI were everywhere. So to some extent it’s just a buzzword companies use to gain notoriety and to infuse a bit of optimism into their forward guidance,” State Street Global Advisors managing director Matt Bartolini told CNN Business when asked about a potential AI bubble.

“You also have a pretty narrow, myopic marketplace in terms of companies leading on AI. A lot of major tech stocks have done well, but smaller companies haven’t. In a bubble, you’d see a significant amount of stocks throughout the area benefiting,” he added. “What is happening is that AI has been around for a really long time, and now there’s a branding bubble, so to speak, where it’s the subject of a lot of press and general conversations around the dinner table. But I don’t think from a stock perspective we’ve reached a full scale bubble.”

At the same time, The Wall Street Journal notes that the AI market is looking similar to the dot com bubble: big sweeping claims, a lot of venture capital, and very little in the way of useful products.

"There's a huge boom in AI—some people are scrambling to get exposure at any cost, while others are sounding the alarm that this will end in tears," Sparkline Capital founder Kai Wu told the WSJ. "Investors can benefit from innovation-led growth, but must be wary of overpaying for it."

At the end of the day though, most of the companies at the head of the AI boom aren’t going anywhere. OpenAI is backed by Microsoft; Google has different market areas like Search and Cloud; and Nvidia and AMD still have other enterprise and consumer offerings. So if this is a bubble and it pops, they’ll all certainly survive. It’s just a matter of what spaces go dry and fallow while VC money chases AI and other companies seek to cram AI into sectors that don’t really have great uses for the technology. (See: NFTs in 2021 and 2022.) And I guess, what happens to all those highly-paid AI-focused employees when the bubble pops, likely in shades of the tech layoff spree of 2022-2023.

Tech ⌨️

FTX’s Sam Bankman-Fried Sent To Jail Over Witness Tampering

FTX founder Sam Bankman-Fried had his bail revoked on Friday after a federal judge accused him of trying to influence witnesses in his upcoming trial. Bankman-Fried had been under house-arrest since his arrest in December, apparently using the time to give personal documents regarding Alameda Research chief executive Caroline Ellison to The New York Times. Prosecutors stated that this was intended to paint one of their star witnesses in the Bankman-Fried trial in a poor light. He also had been talking to author Michael Lewis, who is writing a book of the FTX debacle scheduled to publish a week before the trial begins. Crafting a narrative in the press is not seen kindly for the former crypto king.

Supreme Court Denies Epic Games’ Request To Allow Third-Party App Store Purchases

On Wednesday, the Supreme Court shot down Epic Games’ request to enact a permanent injunction opening the Apple App Store to third-party payment options. The injunction was handed down by U.S. District Judge Yvonne Gonzalez Rogers in 2021, but has been on hold as Apple appeals the decision. Epic Games was hoping that the Supreme Court would let the injunction be active while the appeals process continued, but Justice Elena Kagan denied the request.

Apple Sets Sweetheart Deal With TSMC For New iPhone and Mac Chips

The march of technology is endless and relentless. It seems chip-maker Taiwan Semiconductor (TSMC) will be selling most of its upcoming 3 nanometer (nm) chips to Apple, who will use the chips for future iPhones, iPads, and the M3 processor. The newer manufacturing process means more powerful, more energy-efficient chips for products.

According to The Information, Apple has signed a deal with TSMC to purchase nearly all of the 3 nm output for a year before making it available to other customers. In addition, TSMC will eat the cost of defective chips that result from the process; that’s up to 30% of chips, according to the report. TMSC is making the deal because Apple remains one of its largest customers. Other companies will have to rely on similar chips from Samsung or Intel in the short-term.

X Premium Ad-Sharing Payments Go Out, As Requirements Are Lowered

Following a delay last week, payments for X/Twitter’s premium ad-sharing program finally went out this week. By Thursday, X Support also announced that the eligibility requirements for ad revenue sharing had dropped from 15 million impressions over the past three months, down to 5 million. The minimum payout threshold has also been lowered from $50 to $10.

As that program has been running, government officials in Australia have had questions about who is getting payments. X executives Kathleen Reen and Nick Pickles testified before the country’s Joint Committee on Law Enforcement. While the executives said they had a “zero tolerance” policy regarding content involving child abuse, committee members pointed out that one rightwing influencer was banned for such content in July, only to be allowed back on the platform by owner Elon Musk. That influencer also received payments from the ad sharing program.

“How can you come here and tell us you have a zero tolerance approach when that’s the behavior of your boss only a few short weeks ago?” Senator David Shoebridge stated, according to The Guardian. Only a day prior, ABC (Australian Broadcasting Corporation, not the American one) announced that it was discontinuing the use of its X accounts.

Video Games 🎮

Rockstar Games Acquires Mod Development Team Cfx.re

On Friday, Rockstar Games announced that Cfx.re was “now officially a part of” the studio. Cfx.re is a mod development platform that allows Grand Theft Auto V and Red Dead Redemption 2 players to create unique roleplay and gameplay experiences. Like many games, these tools allow for a long tail, keeping them relevant long after the developer has moved on. It’s almost a lean toward user-generated content like Roblox or Fortnite, though Rockstar Games does not allow users to “make new games, stories, missions, or maps”.

Rockstar Games is making the move ahead of a potential launch of Grand Theft Auto VI. Take-Two Interactive, Rockstar’s parent company, said that a “significant inflection point” is coming in fiscal year 2023, starting in April 2024 and ending in March 2025. Many expect this inflection point will be the release of the next GTA.

Netflix Launches Game Controller App For TV Users

Netflix is slowly expanding in video games, hiring developers and acquiring studios. This week, Netflix released the “Netflix Game Controller” app, allowing subscribers to use game controllers with their televisions to play games. TechCrunch noticed the app on the Apple App Store, with a description stating that it was “coming soon to Netflix”. It’s likely this app will be used to enable a cloud gaming experience as well, something Netflix has already said it’s looking into.

Film, Television, and Streaming 🎞️

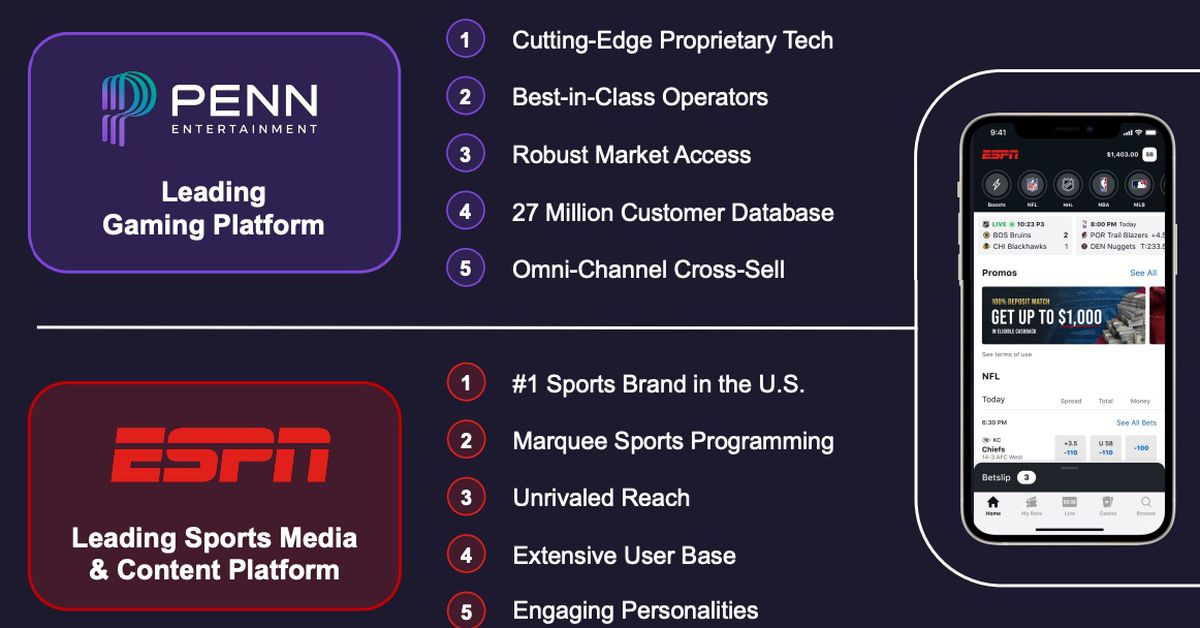

ESPN Turns To Sports Betting With PENN Entertainment Deal

The last brick has fallen in the fight to hold back sports betting. On Tuesday, ESPN announced a deal with PENN Entertainment to launch a branded sportsbook program called ESPN Bet. PENN will run the mobile app and website in the 16 states where it is licensed to operate. The company will pay ESPN $1.5 billion in payments over the deal’s 10-year term, while the latter will use its platform of networks and shows to promote the sports betting app.

As a part of this deal, PENN is also divesting itself of Barstool Sports, selling it back to former owner David Portnoy. Portnoy reportedly bought the company back for $1, after PENN paid $388 million to acquire the site in February. Just throwing money away.

The Shout-Out: The Atlantic has a story called “Sports Betting Won”, which outlines the growth since the Supreme Court deregulated sports betting in 2018.

SAG-AFTRA Working To Cover Reality TV Performers

The Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) is currently on strike, meaning all scripted television shows and films are on hold. Studios are turning to already-filmed projects and reality TV, but there are eyes on the latter now. The Real Housewives of New York City star Bethenny Frankel argued on TikTok that reality TV performers should be included in the fight for better working conditions and pay, pointing out that there are no residuals for her appearances on the show.

SAG-AFTRA agrees. This week, the union said it reached out to Frankel’s representation to begin talks. “SAG-AFTRA is the union that represents reality performers. Depending on the structure of the production and the performers involved, we can cover these performers under our Network Code Agreement,” the union said in a statement. “We stand ready to assist Bethenny Frankel, Bryan Freedman and Mark Geragos along with reality performers and our members in the fight and are tired of studios and production companies trying to circumvent the union in order to exploit the talent that they rely upon to make their product.”

Subscriptions Going Up At Disney+ and Hulu, As Disney Crack Down on Password Sharing

When Netflix cracked down on password sharing, everyone expected a loss in subscribers. That didn’t happen. That means everybody else is going on that train as well. This week during the company’s third quarter earnings call, Disney CEO Bob Iger revealed that they would be addressing password sharing.

“I'd also like to note that we are actively exploring ways to address account sharing and the best options for paying subscribers to share their accounts with friends and family. Later this year, we will begin to update our subscriber agreements with additional terms on our sharing policies, and we will roll out tactics to drive monetization sometime in 2024,” Iger stated during the earnings call.

At the same time, Disney+ and Hulu will be seeing price increases. Ad-free Disney+ will cost $13.99 per month, while ad-free Hulu will cost $17.99 per month. This puts both services closer to the competition: Netflix is $15.49 per month and Max is $15.99 per month. The price increases do make the ad-supported plans, which aren’t changing, look better. They also make the Disney+, Hulu, and ESPN bundle—$19.99 per month for the no-ads Disney+ and Hulu—look great. But Disney has to worry about the direct comparison to its rivals, and eventually customers will start dropping off as combined subscriptions get too high.

AI 🤖

Author Finds Fakes AI-Written Books Under Her Name On Amazon

This week, author Jane Friedman noticed something weird on Amazon and associated book review platform Goodreads. There were a number of books uploaded to Amazon under her name that she hadn’t written. Friedman assumed many of the books were AI-generated. Worse, many of those books were tied to her Goodreads profile as well.

The issue really came into clear view when she tried to get the books removed from Amazon and her Goodreads profile. Amazon originally stated that the books wouldn’t be removed from their online store until Friedman could prove the trademark for her name, which she didn’t have. (They removed the books a day later after the blog blew up on X/Twitter.) Likewise, there’s no clear mechanism on Goodreads for an author to remove works from their profiles.

“We desperately need guardrails on this landslide of misattribution and misinformation. Amazon and Goodreads, I beg you to create a way to verify authorship, or for authors to easily block fraudulent books credited to them. Do it now, do it quickly,” she wrote in her blog.

Other authors commented on the problem as well.

Zoom Rewrites Terms of Service, Won’t User Customer Data For AI

Zoom Video Communications has reversed course on plans to use customer data for training AI, following a week of drubbing on social media and beyond. The pain started on Sunday, when the blog StackDiary noticed that Zoom updated its Terms of Service to give it the right to use all “telemetry data, product usage data, diagnostic data, and similar content or data” to train its AI software. Notably, without any way for customers to opt-out.

Folks felt that this meant that Zoom would use customer teleconference recordings, sparking some of the outrage. By Friday, the company decided to go in a different direction. “Zoom does not use any of your audio, video, chat, screen sharing, attachments or other communications-like Customer Content (such as poll results, whiteboard and reactions) to train Zoom or third-party artificial intelligence models,” says the new Terms of Service.

News Organizations Call For Generative AI Copyright Rules

Several news organizations, including the Associated Press, the News Media Alliance, Gannett, and Getty Images have signed an open letter asking for regulations on the use of their copyrighted content for artificial intelligence.

“Generative AI and large language models are also often trained using proprietary media content, which publishers and others invest large amounts of time and resources to produce. These models can then disseminate that content and information to their users, often without any consideration of, remuneration to, or attribution to the original Creators,” reads the letter.

“Such practices undermine the media industry’s core business models, which are predicated on readership and viewership (such as subscriptions), licensing, and advertising. In addition to violating copyright law, the resulting impact is to meaningfully reduce media diversity and undermine the financial viability of companies to invest in media coverage, further reducing the public’s access to high-quality and trustworthy information.”

Two weeks ago, the Biden Administration met with AI companies to discuss guidelines around AI. Like this open letter, there wasn’t much in the way of teeth to it.

Layoffs and Labor 👷

Marvel Studios On-Set VFX Workers Move To Unionize

On Monday, Visual Effects (VFX) crews at Marvel Studios filed for a unionization election. The group is hoping to be represented by the International Alliance of Theatrical Stage Employees (IATSE). The union of choice is key, as these are the on-set VFX workers at Marvel Studios, not the larger, outsourced VFX houses most associate with “VFX” in regards to the Marvel Cinematic Universe. Still, there’s the hope that by starting with this 50-worker crew, the unionization effort can expand to those other VFX studios.

WGA and SAG-AFTRA Strikes: WGA amd AMPTP Meet Again, Negotiations Resume Next Week

The Writers Guild of America (WGA) strike hit day 100 this week, on Wednesday. Two days later, the WGA and Alliance of Motion Picture and Television Producers (AMPTP) met again to resume bargaining on a new deal. The AMPTP offered a counterproposal for the WGA’s demands, with the latter guild planning to submit a response next week. Hopefully, that means that there’s a light at the end of the tunnel for writers and story editors, with perhaps some semblance of a deal on the horizon.

CAA Lays Off 60 Employees

Creative Artist Agency (CAA) is one of the major Hollywood talent agencies. This week, the agency laid off around 60 employees within the company. The cuts were done in multiple divisions, and despite happening amid the WGA and SAG-AFTRA strikes, insiders told Variety that the layoffs were planned months before the strikes started. CAA majority stakeholder TPG is also looking to sell its stake in the agency, likely to billionaire Francois-Henri Pinault, founder of luxury goods company Kering.

Books 📚

Paramount Sells Simon & Schuster To KKR

On Monday, Paramount Global announced that it had agreed to a deal to sell book publisher Simon & Schuster to investment company KKR for $1.62 billion. Under its new parent company, Simon & Schuster will remain a standalone entity under its current executive management.

This purchase follows federal judge Florence Pan and the Justice Department blocking the merger between rival book publishers Penguin Random House and Simon & Schuster in October of last year. Penguin Random House owner Bertelsmann agreed to purchase Simon & Schuster for $2.175 billion back in 2020, but with the blocked merger, Paramount needed a new buyer.

As an odd related tangent, Image Comics signed a deal with Simon & Schuster to publish its graphic novels in North America last week.